Grace

Product Manager

Strategic Planner

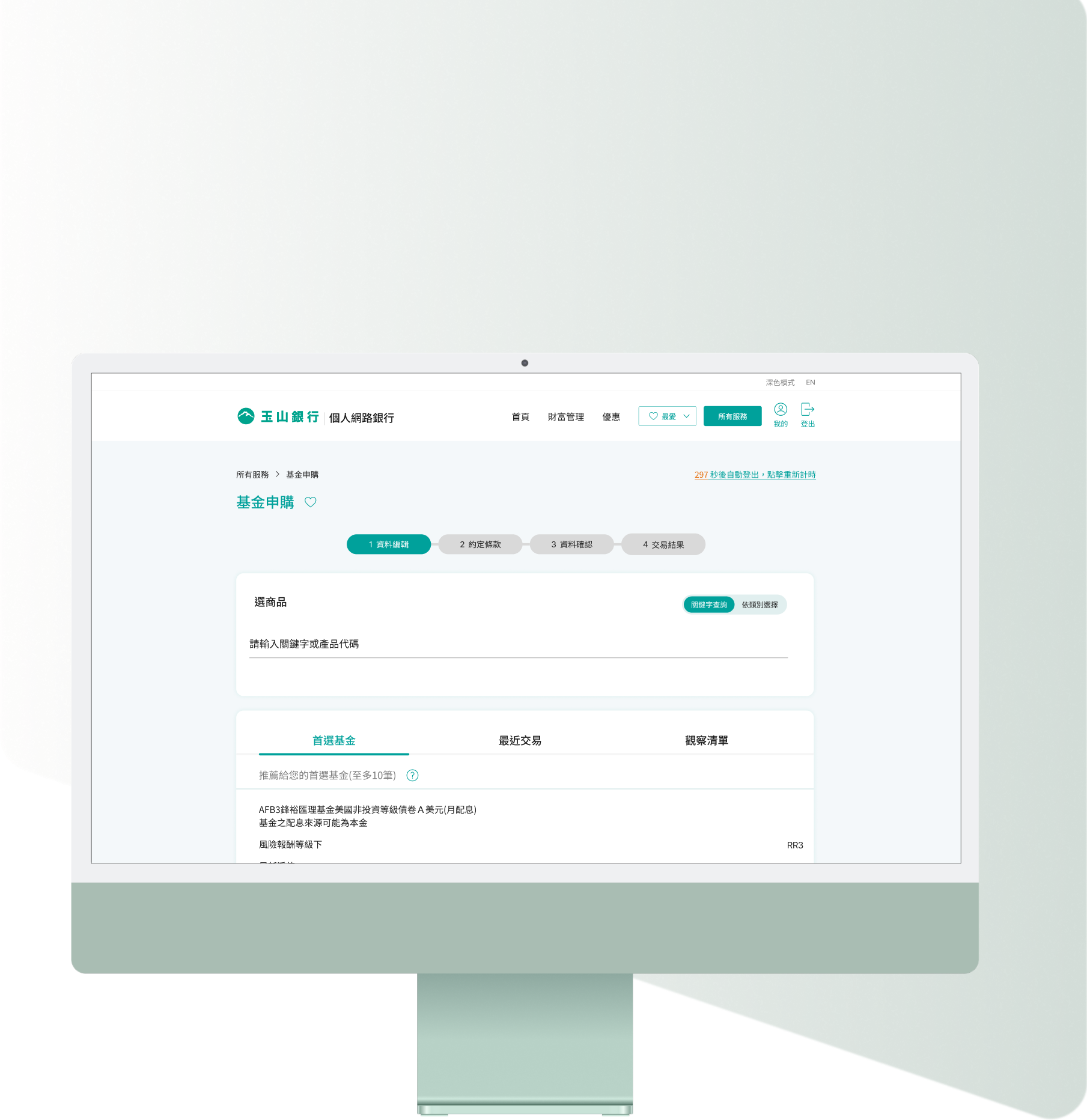

Seamless cross-device integration for a consistent and user-friendly online banking experience.

# Personal Contributions

1- Testing the shopping cart can prevent duplicate orders.

2- Enhance cross-selling and asset integration capabilities.

3- Lower subscription costs and lighten workload.

4- Optimizing marketing with data collection

Traditional fund purchase used cumbersome single-order processes, increasing workloads for investors and banks. With e-commerce trends favoring one-stop, batch ordering, banks face pressure from online platforms and fees. To improve efficiency, reduce costs, and meet digital-savvy users’ expectations, management plans to adopt a “shopping cart” model to enhance user experience and competitiveness.

Old fund purchase were slowed by long searches and repetitive orders, causing delays and payment failures. These issues increased user frustration and customer service work. A shopping cart model consolidates orders, reduces steps, and simplifies payments, improving efficiency and user experience.

Fund investors can be grouped by lifestyle and investment habits: Mobile Traders seek fast, real-time actions via mobile for short-term gains. Strategic Planners prefer laptops, value in-depth research and long-term planning. Family Investors focus on financial security, managing funds with family at home. Understanding these segments helps tailor interfaces and features to match their needs.

Solution

Solution

Conclude

More

We conducted research and interviews on the information presented in the fund subscription cart, focusing on the clarity of key information and the readability of content as primary evaluation criteria.

This A/B test compares two fund purchase flows with distinct journey breakpoints.

Flow A: Select fund → Set details → Add to cart

Flow B: Add to cart → Set details at checkout

We measured efficiency, error rate, and user preference.

Test 1

Test 2

#Unlike regular e‑commerce, customers view fund purchase as financial transactions that require careful handling.

#Customers prefer to edit transaction details before adding them to the cart. (7 out of 8 interviewees preferred this approach, accounting for 88%.)