Amber

Marketing

Price-Driven Buyers

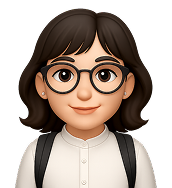

Seamless cross-device integration for a consistent and user-friendly online banking experience.

# Personal Contributions

1- Increase Online Purchase Conversion Rate 40%

2- Enhance User Risk Education and Transparency

3- Speed Up Purchase & Reduce User Time

4- Promote Cross-Platform Service Integration

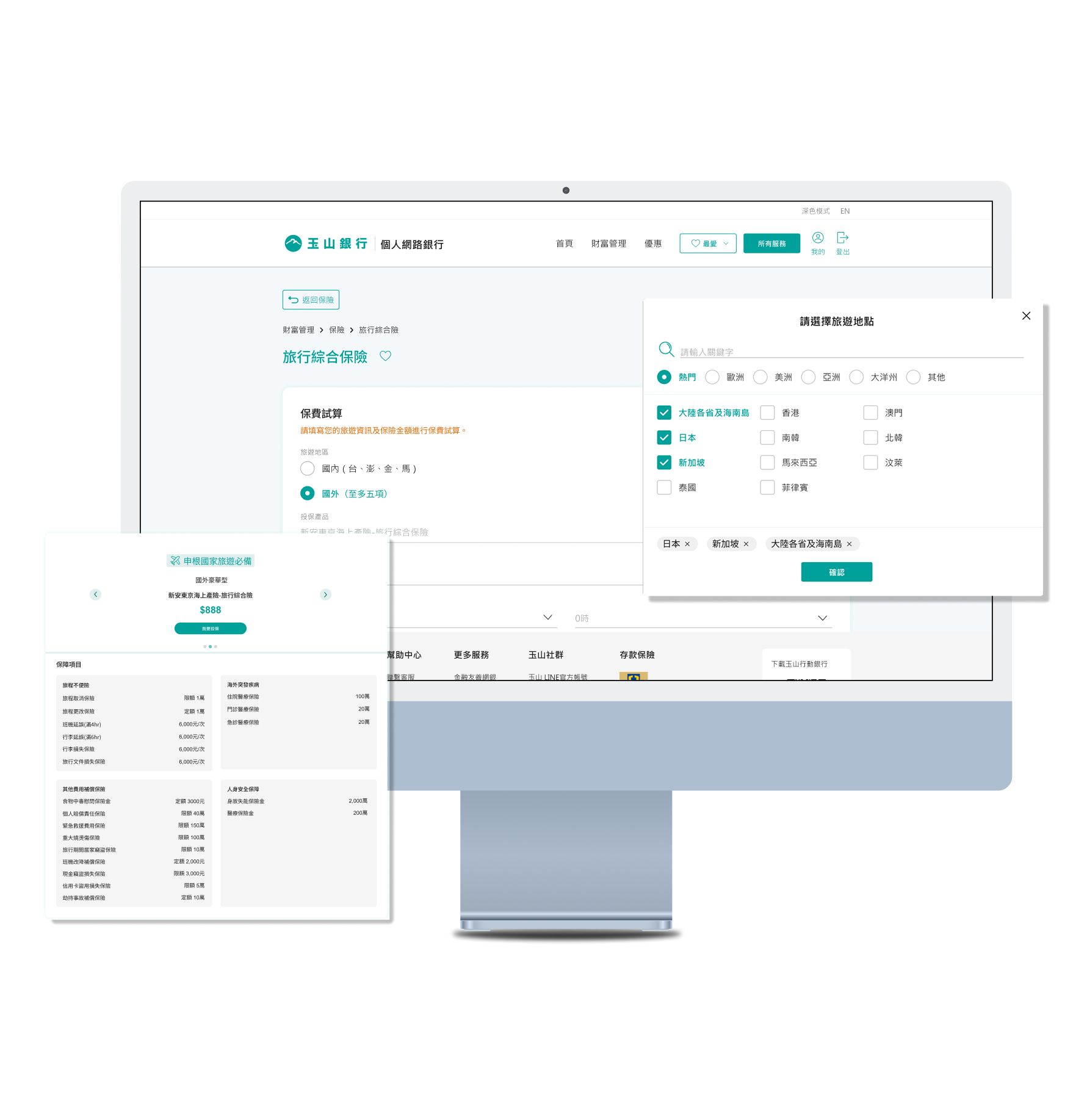

This project aims to optimize the online purchase process for travel insurance by simplifying steps and information display, reducing the time users need to complete a purchase. The focus is on minimizing input fields, improving system response speed, and providing intuitive guidance to enhance the overall user experience and conversion rate

After reviewing the online travel insurance purchase flows of various providers, I created an initial prototype and conducted user interviews. Most users tended to drop off at the “Insured Information” step, mainly due to difficulties in gathering required details and the excessive number of form fields. This pain point was also reflected in behavioral data — the “Insured Information” page had the longest average completion time, followed by the product selection step.

This project optimizes the online travel insurance flow through three key personas: price-sensitive young users, risk-aware planners, and family-oriented buyers. These personas highlight distinct needs and behaviors, guiding design decisions to improve user experience and boost conversion.

Solution

Solution

Conclude

More

Show coverage differences visually with real-time premium estimates, helping users quickly compare, understand, and choose the best plan.

Personalize add-ons based on past purchase habits to simplify choices and boost conversions.

Allow users to add multiple beneficiaries and view payout ratios in a collapsed view, reducing visual clutter while keeping info easy to review.