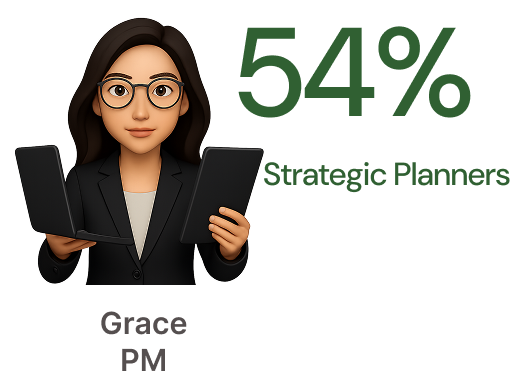

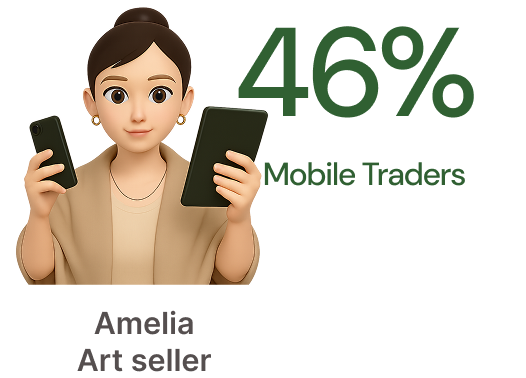

Who uses the Digital Bank

E.sun Digital Bank users span two key types: planners seeking structured insights and traders needing quick, mobile‑first access.

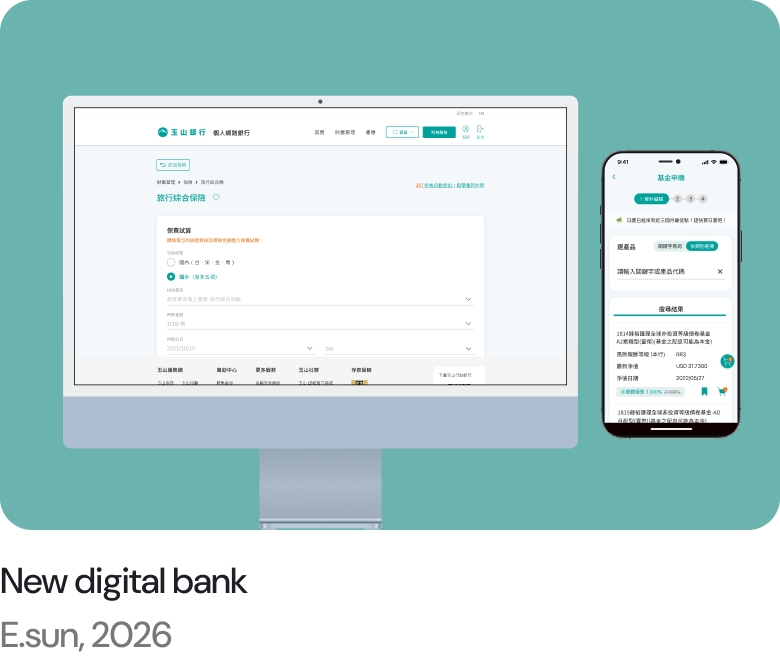

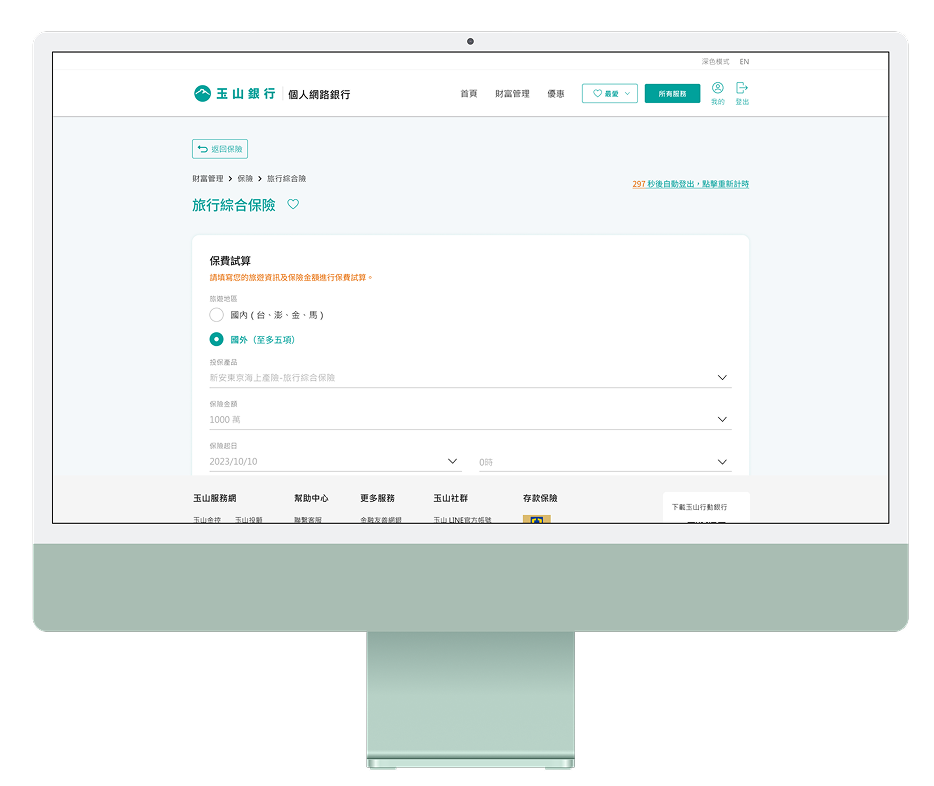

Seamless cross-device integration for a consistent and user-friendly online banking experience.

| Goals: |

# Provide full online financial services across App and Web.

| Challenges: |

# Complex, multi-layered features requiring simplification.

# Product ownership spread across departments.

# Heavy cross-functional collaboration with product, design, engineering, and compliance.

E.sun Digital Bank users span two key types: planners seeking structured insights and traders needing quick, mobile‑first access.

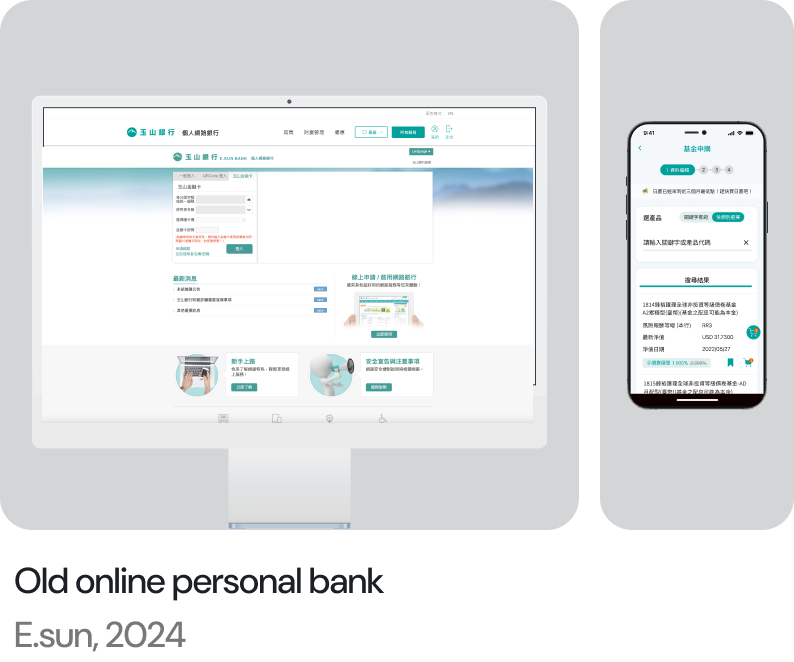

Data shows that E.sun Bank Digital Bank users access the service through diverse channels — PC, mobile, and cross‑platform usage. However, user satisfaction fluctuates significantly across these devices, highlighting the need for a unified experience to ensure consistent performance.

The previous online banking system used separate PC and mobile interfaces with inconsistent flows, leading to usability gaps. The redesigned digital bank offers a unified interface and seamless workflows across devices, boosting efficiency and user satisfaction.

The redesign followed two main tracks: refining existing flows and creating new ones from scratch. Both began with wireframes and prototypes, validated through testing before progressing to high‑fidelity mockups and finalized design guidelines.

I developed two distinct processes for A/B testing and evaluated user preference between them. By integrating metrics with interview feedback, I delivered a thorough analysis to support design decisions.

I created an interactive prototype for the fund purchase flow and supported the planning and execution of user testing. This enabled rapid validation of design ideas, improved usability and satisfaction, and sped up the overall design iteration.

I was responsible for analyzing test results, assisting the team in using NPS scores to evaluate user satisfaction, and testing the feasibility of Kano questionnaires. By providing strong data support, I helped the team make informed product improvement decisions.

UI/UX planning for multiple digital banking features, producing wireframes and mockups, and assisting with interviews and user research.

I contributed to building a modular design system, defining cross-platform design tokens, and creating reusable patterns that improved team workflow and onboarding efficiency. After launch, the overall UI bug rate dropped by 25%.